ETH Price Prediction: SharpLink Adds $200M in ETH, Treasury Value Expected to Surpass $2B

Preface

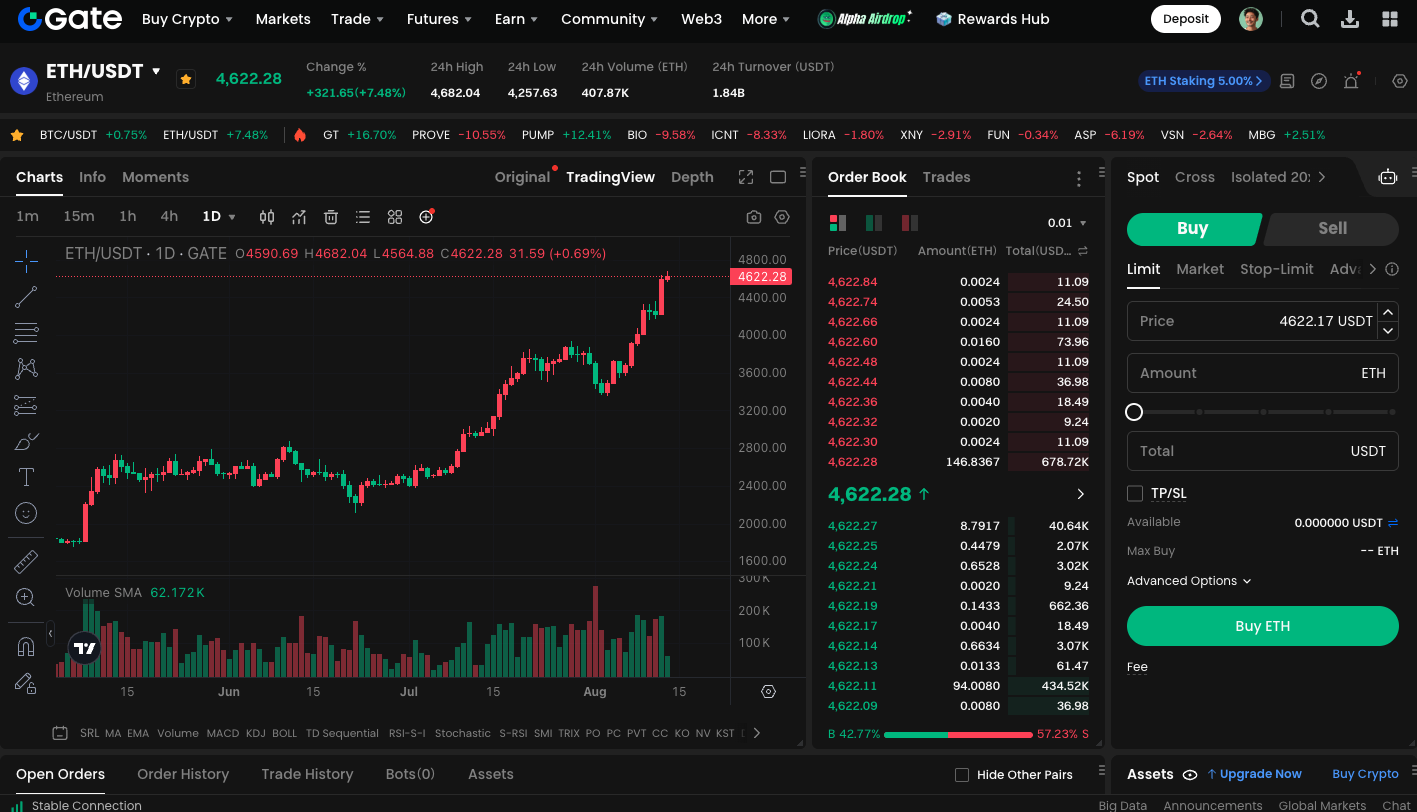

Ethereum (ETH) is currently priced at approximately $4,620, outpacing most major altcoins. The latest move by SharpLink, a publicly traded company on the Nasdaq, may contribute to increased market confidence in ETH.

SharpLink Aims for a Long-Term Strategy

SharpLink announced that it has entered into agreements with four institutional investors to sell shares at $19.50 each via an at-the-market (ATM) offering, aiming to raise $200 million. The company noted that these funds will be dedicated to expanding its Ethereum holdings. Once deployed, the total market value of SharpLink’s ETH holdings is expected to exceed $2 billion.

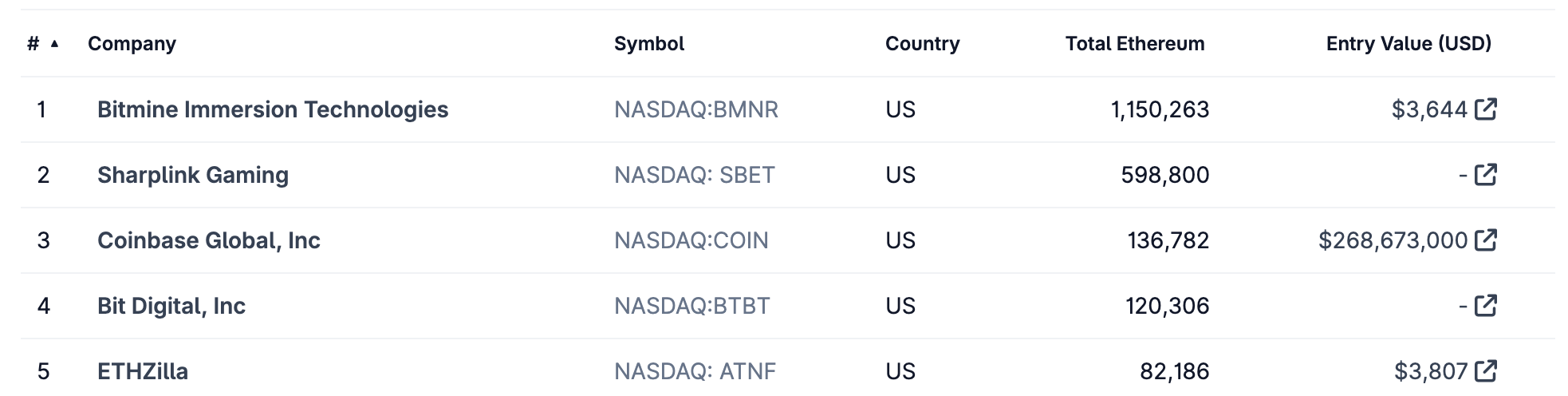

SharpLink Climbs to Second Place in Corporate Ethereum Holdings

SharpLink began acquiring ETH in June this year, raising $450 million in a funding round led by Consensys, a leading Ethereum infrastructure provider. According to the latest data from Coingecko, the company now holds 598,000 ETH, with a market value in the billions of dollars. This places SharpLink second to BitMine Immersion (BMNR), which is backed by Peter Thiel and holds 1,150,263 ETH.

(Source: Coingecko)

Expanding from Esports to Crypto Wealth Management

SharpLink was originally known for its esports gaming operations, but in recent years has actively expanded into digital asset acquisition. In early 2025, the company filed a $1 billion fundraising registration with the U.S. Securities and Exchange Commission (SEC), and in July raised the ceiling to $6 billion, establishing a foundation for a long-term digital asset acquisition strategy.

ETH Price Outlook

With institutions like SharpLink continuing to ramp up their positions, long-term demand for ETH is expected to climb steadily. In the near term, if the price holds above $4,600, the market could test the resistance range between $4,800 and $5,000. If the price declines, initial support is at $4,500, with additional support at $4,350.

To begin ETH spot trading, visit: https://www.gate.com/trade/ETH_USDT

Conclusion

SharpLink’s large-scale purchases not only underscore ETH’s importance as a corporate reserve asset. They may also contribute to the next upward movement in the market.

Related Articles

Pi Coin Transaction Guide: How to Transfer to Gate.io

What is N2: An AI-Driven Layer 2 Solution

Grok AI, GrokCoin & Grok: the Hype and Reality

How to Sell Pi Coin: A Beginner's Guide

Crypto Trends in 2025